Just How Accurate Are Your Monthly Financial Statements?

A very common Project Management and Financial Reporting story

John (not his real name but a real client) was the CEO of a growing private business developing software for construction and energy companies. Most of their projects took many months to complete. They would incur project costs on a weekly, bi-weekly or monthly basis. However, as with many software, construction and energy services companies, their contracts dictated invoicing could only occur upon completion of various project stages or milestones. Therefore, while they were actually earning project revenue each month, they were not able to invoice for that work until much later in the cycle.

At the end of every month, John and his internal accountant would meet his various project managers for one hour to review the status of every project. Project managers would sit nervously in his outer office awaiting their turn. John was after three specific things in every project meeting:

- Margin Creep – Is the current month’s margin consistent with previous months and the budget?

- Change Orders – Were there any change orders in the month and, if so, what was the margin earned on each of those change orders?

- Unbudgeted Costs – Were there any new costs identified in the projects that were either not budgeted for or not subject to a previous change order?

What he was doing monthly was managing the margins to ensure that each project was on budget and any additional costs or other issues were identified immediately. He knew full well how a lack of attention to project management and poor financial reporting would inevitably lead to decreased project margins, some of which possibly would not even be discovered until after projects were completed.

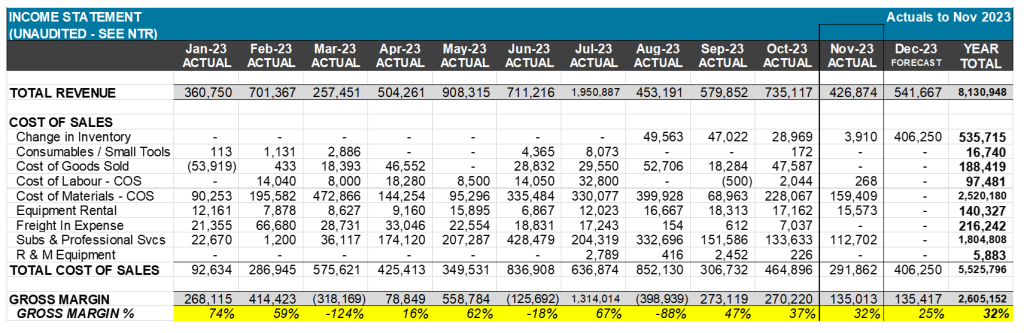

Have you ever seen a monthly income statement like the one below?

Note the huge fluctuations in gross margins and margin % month over month (yellow highlights). When you look at the totals for the year, this is a great business carrying a respectable 32% overall gross margin. However, to an outsider, the extreme variations month to month might very well give cause for concern.

Why is this rollercoaster ride happening and what are the potential implications if this was you and your business?

Invoicing is not an appropriate measurement of earnings

In financial accounting and reporting, there are a number of basic financial accounting and reporting principles, guidelines and recommendations to which all accountants must adhere. Two very important ones are the Matching Principle and Revenue Recognition which requires revenue earned and expenses incurred to be recorded in the periods or months they actually occur. Revenues and expenses are being matched together (the “accrual” basis), as opposed to recorded only when you are paid by your customer or when you pay your supplier (the “cash” basis).

If your company works on projects, manufactures goods or provides services that extend over one or more months and you do not follow the above principle, income statements like the above example may result. What you are seeing on a project-by-project basis, is a curious mix of:

- specific project revenue only being recorded when an invoice is “sent out” to the customer, not when the revenue was “earned” (see July 2023),

- 3rd party expenses not being recorded until the invoice is “received” from the supplier where the service or product was likely provided or incurred in a previous month(s),

- cash received from customers or payments made to suppliers in the form of deposits which are being recorded immediately as project revenue or expenses, and

- many of the expenses being correctly recorded in the same month as incurred (payroll).

The overall result is very erratic monthly gross margins due to:

- specific project expenses recorded in one month(s), with no associated earned project revenue recorded in that same month (due to invoicing only allowed subject to milestone achievement), and then,

- large amounts of project revenue recorded in a later month with no associated project expenses recorded in that same month (they were recorded in earlier months).

I have seen many of our clients’ income statements which look this way. In virtually every case, the reason is nothing more than the client’s internal accounting team does not understand the Matching Principle and does not employ a proper Revenue Recognition policy. Fortunately, the client’s external year end accountant reviewed or audited its year end financial statements and made adjustments to accrue a certain amount of project revenue earned but not invoiced by year end and/ or accrue certain expenses incurred but not yet paid as of the end of the same year.

This is done to ensure your year end financial statements adhere to this principle and the company has a revenue recognition policy in place that fits the type of work and services performed by the business.

The problem is your year end accountant never took the time to educate your internal accountant as to how to do this properly, on a monthly basis. Therefore, not only does the year end review or audit cost more but your monthly internal financial statements used for decision making were likely not correct. They were correct just once a year – at year end. Unfortunately, that year end statement is usually received back from your accountant at least 3 – 4 months after the year end. By then, it is not really even current financial information.

Implications of inaccurate financial reporting

There are potential short and long term implications. Monthly, your financial statements are not correct. They are reporting distorted positive or even negative monthly margins. You may be okay with this, but those monthly financial statements may also be sent to your banker, other lenders or stakeholders who have a specific expectation that the monthly statements are accurate. They will realize very quickly that something is wrong and inevitably will call to ask questions.

There are possible negative implications to the monthly balance sheets as well. These might include:

- understatement of current assets resulting from earned, but not yet invoiced project revenue (unbilled revenue), and

- understatement of current liabilities resulting from receiving payments from customers in advance of earning the related project revenue (unearned revenue).

The details of the balance sheet impacts would need to be part of a separate blog.

As a result, you may inadvertently be impacting your management credibility, at least from a financial perspective. Lenders may then perceive more risk. In times such as this where credit is very tight and expensive, you can expect this to be an issue. This, in turn, can lead to additional credit not being accessible and / or higher rates reflective of the risk perceived by the lender. This could have all easily been avoided.

Lastly, if you are making business decisions based on inaccurate financial statements, the risks are obvious.

The way to begin to correct this issue is firstly to understand and accept that within your project management and reporting system, there exists two separate processes:

- “Earning revenue” and “incurring costs” each month (regardless of when you get paid or pay). Your accountants and project managers need to capture, manage and report on this monthly.

- “Invoicing customers” and “paying employees and suppliers”. Your accountants need to manage and report monthly on this as a separate process.

From there, begin to create the processes necessary to accurately report monthly project margins. If margins do change, the reasons will be very clear. In order to understand if you need to implement new processes to properly recognize revenue and related expenditures in the applicable periods, I suggest addressing the following:

- Does your provision of services or contract work tend to extend over a longer period of time?

- If so, determine, with the help of your year end accountant, if your revenue recognition policies require the company to recognize revenue on a % completion basis on a portion or all of your revenue. They will know the specific requirements based on the type of work you are doing, your ability to track the progression on each project and how to properly calculate monthly revenue earned,

- Are you adhering to this policy only at year end, or quarterly or monthly?

- Are you being paid up front for any material portion of your services or products?

Given the results from above, you will need to develop a management reporting process that will capture at least the following for each project:

- Contract or Project total revenue value,

- Contract or Project start dates and estimated completion dates,

- Total project costs incurred monthly and year to date,

- Change orders and the related costs and scope of work,

- % of costs incurred to date relative to total budget cost (% completed),

- Calculation of monthly revenue “earned” or “recognized” by multiplying the % completed by the project contract revenue value,

- Total $ amount of any payments received in advance from customers, and

- Total $ amount of invoices sent out to customers.

Consider starting with your largest projects (selected by materiality) then add in the smaller projects using the same process once you and your team (project managers and accountants) have the processes acceptably refined.

The importance of understanding the Matching Principle and your Revenue Recognition accounting policy and meeting their requirements is a critical step to ensuring your monthly income statement and balance sheet is accurate. What you should see is a consistent margin percentage on all your projects, month over month. Where margin variations exist, the reasons are easily identified, understood and necessary actions immediately taken. This will also improve knowledge of the financial aspects of project management and perhaps accountability therein.

If you would like further information on what this reporting process could look like or want to discuss further, any one of our advisors would be happy to share our knowledge with you.

Brian McGill, CPA, CA – Stawowski McGill brian@stawowskimcgill.ca